About Utkarsh Small Finance Bank Limited

Utkarsh Small Finance Bank Limited (USFBL),(NSE/BSE UTKARSHBNK) incorporated on April 30, 2016, is engaged in providing banking and financial services with a focus on providing microfinance to the underserved and unserved sections of the country. The Bank’s lending activities are primarily focused in rural and semi-urban locations of the country while its other services are spread across the country. The Bank commenced its operations on January 23, 2017, pursuant to the small finance banking licence granted by RBI on November 25, 2016.

The Bank extends microfinance loans based on Joint Liability Group (JLG) model to individuals, other retail asset loans including Micro, Small and Medium Enterprise (MSME) Loans, Housing Loans (HL), Personal Loans, Commercial Vehicle Loans, Construction Equipment Loans and Wholesale Lending to borrowers.

The Bank offers a slew of digital services such as Internet and Mobile Banking, Digi On-Boarding, and an online account opening facility for clients, besides a range of ATMs and Micro ATMs for ease of transactions, amongst others.

The Bank is headquartered at Varanasi, Uttar Pradesh.

Vision

To be the most trusted, digitized bank that is financially and socially inclusive, and creates value across social strata through insightful and viable solutions

Mission

Be the preferred financial institution across all customer segments through technology enabled solutions that are sustainable, inclusive, and scalable, supported by a work culture that centers on passion, values and corporate ethics to deliver best in class customer experience.

P

Persistence is our innate quality

R

Responsible & Ethical in our dealings

I

Inclusive in our approach

D

Diligent in our process

E

Excellence in all that we do

From a Micro Finance Institution (NBFC-MFI) to a Small Finance Bank (SFB)

| Instrument | Rating | Outlook |

|---|---|---|

| CD | ICRA AI+ | NA |

| Tier II | Care A and ICRA A | Stable |

Capital Structuring & Fund Raise Committee

Corporate Social Responsibility Committee

Credit Approval Committee

Customer Service Committee

IT Strategy Committee

Nomination & Remuneration Committee

Review Committee for Identification of Wilful Defaulters

Risk Management Committee

Special Committee of the Board for Monitoring and Follow-up of cases of Frauds

Stakeholder Relationship Committee

CREDIT MODELLING & RISK TEAM OF THE YEAR’ AWARD AT THE INDIA CREDIT RISK SUMMIT & AWARDS 2024

YEAR - 2024

MOST PREFERRED WORKPLACE 2023-2024 (BFSI EDITION) BY MARKSMEN DAILY

YEAR - 2023

Best Customer Experience at 18th Annual Summit and Awards by ASSOCHAM

YEAR - 2023

Best Customer Experience Strategy by India Customer Excellence (CX) Summit & Awards 2023

YEAR - 2023

Employee Excellence 2023 by the Times Group – ET EDGE

YEAR - 2023

Shri. Alok Pathak was recognised as the Chief Risk Officer of the year at BFSI Convex by Gain Skills media company.

YEAR - 2023

Most Trusted BFSI Brands by Teammarksmen Daily

YEAR - 2023

APY Excellence Award

YEAR - 2023

Best Emerging Business Partner by Volvo Eicher Commercial Vehicles (VECV) for Bihar.

YEAR - 2023

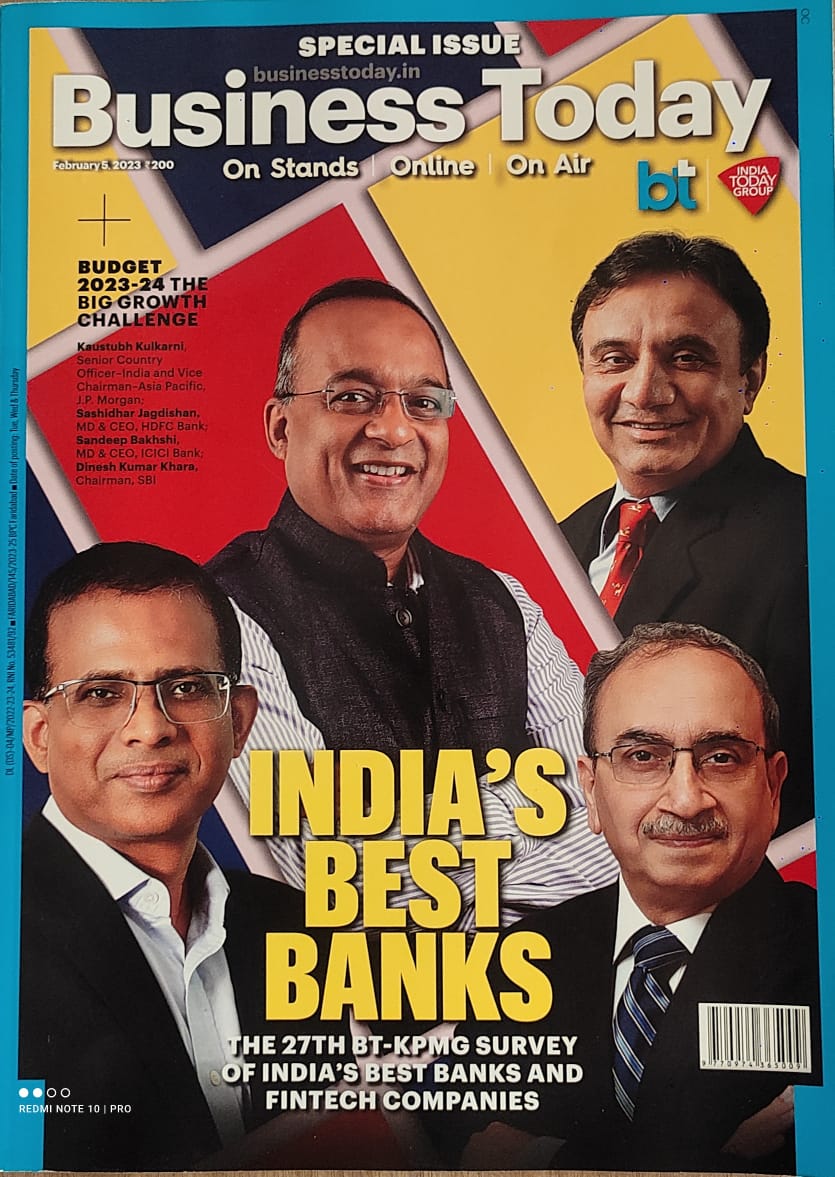

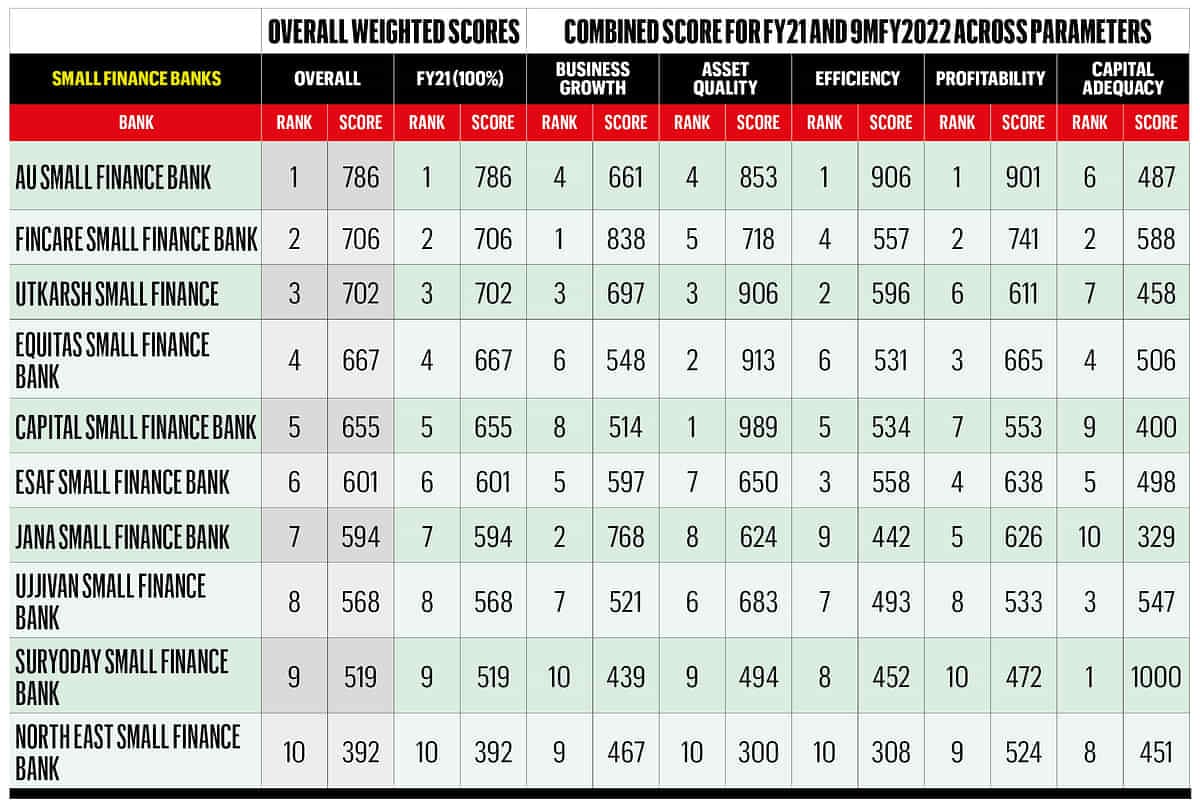

Ranked No.2 Under The Small Finance Bank Category By Bt-kpmg Survey – February 05, 2023 Issue

YEAR - 2023

Ranked No. 3 amongst Small Finance Bank – Fortune magazine 2022

YEAR - 2022

RANKED NO. 3 AMONGST SMALL FINANCE BANK – FORTUNE MAGAZINE 2022Utkarsh Small Finance Bank amongst the “The Next 500 Companies 2022”

YEAR - 2022

Recognised As Brand Of The Year 2022” By Team Marksmen Daily And Media Partner India Today

YEAR - 2022

Recognition As One Of The "promising Brands 2022" By Economic Times

YEAR - 2022

Griha Award Was Bestowed Upon Us For The Integrated Water Management At Utkarsh Tower

YEAR - 2022

Pfrda Award For Qualifying The Contest "beat The Best & Be The Best (9th May, 22 To 30th June,22)"

YEAR - 2022

Best It Risk & Management At The Indian Banks’ Association Banking Technology Awards 2022

YEAR - 2022

Epitomising Excellence in the BFSI industry 2021 by Team Marksmen & NDTV 24x7

YEAR - 2021

Best Brand 2021 by The Economic Times

YEAR - 2021

Best Places to work in India 2021 - by Ambition Box

YEAR - 2021

.png)

Most Trusted Brands of India by Team Marksmen and CNBCTV18

YEAR - 2021

Best Small Finance Bank by Business Today - KPMG

YEAR - 2020

State Level Outstanding Performance Award by NABARD

YEAR - 2020

Social Impact Initiatives, 2019

YEAR - 2019

.png)

Mine Media Excellence Award 2019 (Excellence Award)

Year - 2019

MFIN Microfinance Awards (Effective Grievance Redressal Systems)

Year - 2018

SKOCH ORDER-OF-MERIT

Year - 2016

MSME Banking Excellence Award - 2015 Chamber of Indian Micro, Small & Medium Enterprises.

Year - 2015

Smart Campaign Client Protection Certification June 2015

YEAR - 2015

MF Pricing Transparency - Seal of Pricing Transparency Award Aug 2013 – Aug 2014

Year - 2014

MIX S.T.A.R. MFI

Year - 2013

Microfinance India Organization of the Year (Small & Medium Category) Awards 2012

Year - 2012