Product Overview

Use our NACH (National Automated Clearing House) service to collect recurring payments by registration of debit mandate of end customer via physical or electronic mode (e-Mandate).

Get

Rewards

1 reward point on every 100 spends on debit card

Get

15% discount

1 reward point on every 100 spends on debit card

Get

Free

Cash withdrawal on Utkarsh Bank ATMs

- There is no need to clear cheques, which saves time. Quick payment acceptance helps establish stronger customer connections.

- The elimination of large amounts of cheques simplifies the payment procedure. Effortless customer service, bill payments, and simple money transfers to several recipients.

- Quickly manages recurring payments. All transactions are settled within a day, there is no need to memorise payment dates.

- Easy cancellation of mandates. A safe and secure procedure utilising just net banking credentials.

- Increased customer retention : - A one-time authentication allows you to debit the customer’s Bank Account on a set date. Hassle-free collection thus increases customer experience.

- Recovery of funds in a recurring manner : - Payments will be deducted from the customer’s Account on the mutually decided date periodically.

- Better Tracking : -The Unique Mandate Registration number allows you to keep a track of payments received.

E-NACH

Physical NACH

For physical NACH mandate registration, collect the NACH registration form from your customer and share it with the Bank either physically or digitally.

Eligibility & Documentation

- Corporates must submit the “User Registration Form” as per the format defined by NPCI, which has to be submitted to Utkarsh Small Finance Bank in order to get on boarded into the NACH platform.

- The form should be submitted by the corporates on their letterhead.

- The form should be duly signed by the authorised officials with their official stamps.

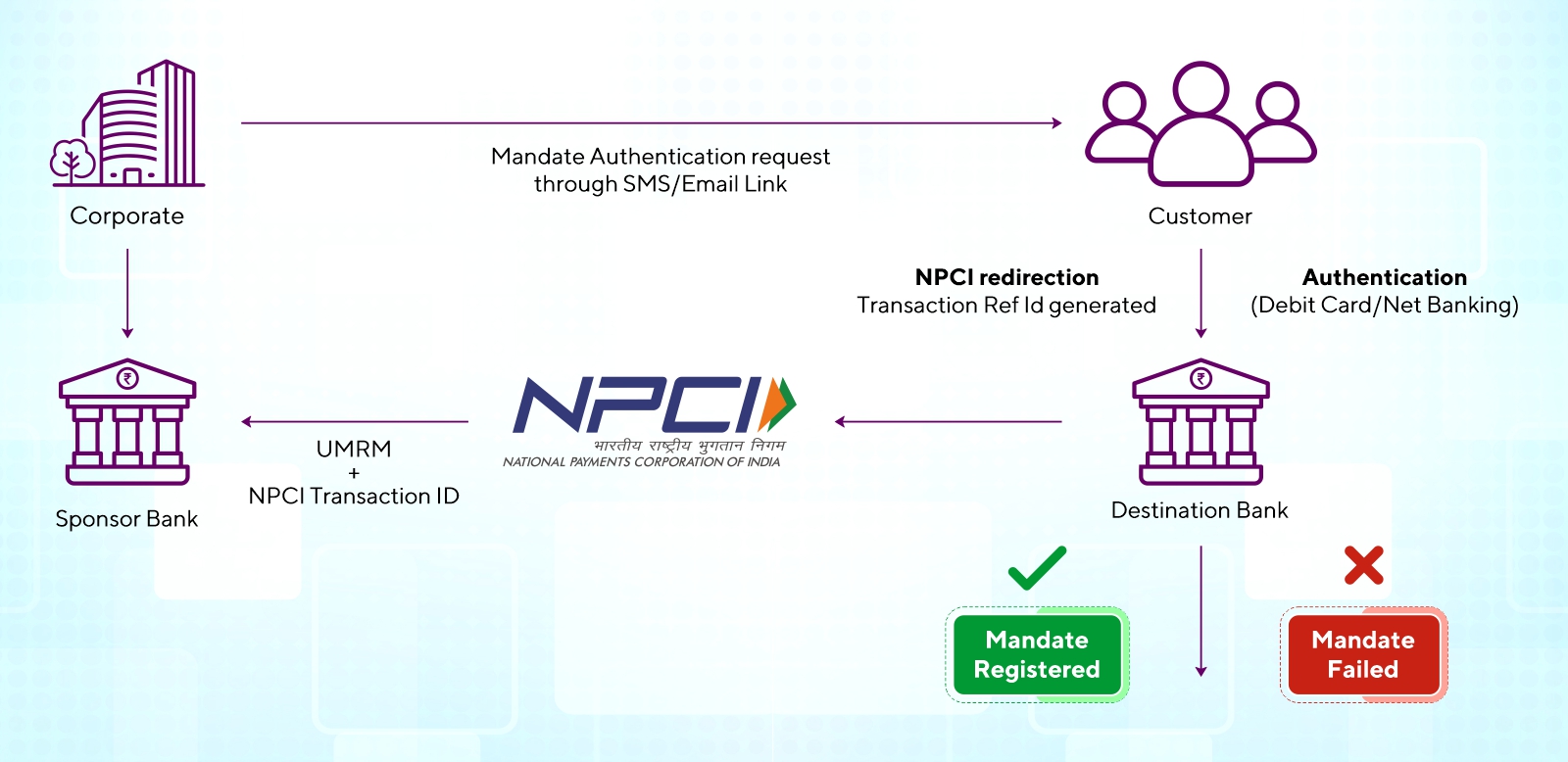

Process Flow for Mandate Management as a sponsor Bank Click here

For detailed fees and charges please contact your Relationship Manager or visit your nearest branch.

Loan calculator

|

Interest Rate 8.00% |

Interest Earned 3,50,452 |

|

Maturity Value 13,50,452 |

Maturity Date 20 Apr 2023 |

|

(Indicative interest rates for calculation only. click here for latest rates.) |

|

FAQs

NACH is an electronic clearing system developed by NPCI to facilitate high-volume, recurring transactions between banks. It serves as a modern replacement for the ECS system.

There are two main variants:

• NACH Debit – Used for collecting payments from customers.

• NACH Credit – Used for disbursing payments to beneficiaries.

NACH Credit allows organizations to transfer funds like salaries, pensions, dividends, and interest to multiple recipients through a single debit to their account.

NACH Debit enables businesses to collect recurring payments such as EMIs, utility bills, and insurance premiums from customers automatically.

A mandate is a one-time authorization given by a customer to their bank, allowing automatic debits from their account based on specified frequency and amount.

UMRN stands for Unique Mandate Reference Number. It is a system-generated ID assigned to each mandate and is required for tracking, modifying, or cancelling mandates.

Corporates must apply through their bank to NPCI. Once approved, NPCI assigns a Utility Code, enabling them to initiate NACH transactions.

A Utility Code is a unique identifier assigned by NPCI to corporates using NACH services. Each bank relationship may result in a separate code.

The Sponsor Bank is the bank that submits NACH transaction files on behalf of the corporate.

The Destination Bank is the bank that processes incoming NACH transactions for its customers.

Log in to your bank’s corporate portal, enter the relevant account and mobile number, and update the necessary details.

Yes, cancelling a mandate stops all future payments under that authorization.

Yes, you can suspend a mandate and reactivate it later without creating a new one.

Yes, you’ll receive an SMS confirmation for any action taken—amendment, cancellation, suspension, or reactivation.

Changes are processed in real time, and notifications are sent immediately.

No, there are no charges for amending, cancelling, or suspending a mandate.

The payment will not be processed. You’ll need to reactivate the mandate or arrange an alternative payment method.

Cancelled mandates cannot be reinstated. You’ll need to create a new mandate. Suspended mandates can be reactivated.

Visit your nearest bank branch for assistance with mandate-related issues.

You may also be interested in

Savings

Earn up to 7.50 %* on your Savings Account and get interest credited quarterly

Deposits

Earn interest rates up to 7.65 %* p.a. and 8.15 %* p.a. for Senior Citizens

Loans

Get Loan amount upto 10 Crores with Flexible Tenure upto 15 years

Insurance & Investment

Turn your surplus funds into security, for a better tomorrow